UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Filed by the Registrant ☒ | |

| Filed by a Partyparty other than the Registrant ☐ | |

| | | | | | | | |

| Check the appropriate box: | |

| | |

| ☐☒ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☒☐ | Definitive Proxy Statement |

| | |

| ☐ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material under §240.14a-12 |

PHREESIA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): | | |

| | | |

| ☒ | No fee required. | |

| | | |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| ☐Payment of Filing Fee (Check all boxes that apply): |

| Fee paid previously with preliminary materials. | |

| ☒ | No fee required. |

| | | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee wasFee paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | previously with preliminary materials. |

| | | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

| | | and 0-11. |

PRELIMINARY PROXY STATEMENT - SUBJECT TO COMPLETION

Phreesia, Inc.

432 Park Avenue South, 12th Floor1521 Concord Pike, Suite 301, PMB 221

New York, New York 10016Wilmington, DE 19803

May 27, 2020

NOTICE OF FISCAL 20202023 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD JULY 8, 2020JUNE 28, 2023

Dear Phreesia Stockholder:

We are pleased to invite you to attend the 20202023 Annual Meeting of Stockholders (the “Annual Meeting”) of Phreesia, Inc. (“Phreesia”) to be held on July 8, 2020June 28, 2023 at 9:00 a.m. Eastern Time, virtually, via a live audio webcast on the Internet at www.virtualshareholdermeeting.com/PHR2020.PHR2023. You will be able to attend and participate in the Annual Meeting online by visiting www.virtualshareholdermeeting.com/PHR2020,PHR2023, where you will be able to vote electronically and submit questions. You will not be able to attend the Annual Meeting in person. You will need the 16-digit control number on your proxy card to attend the Annual Meeting.

We are holding the Annual Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

1.To elect the three Class I directors named in Proposal One to serve until the fiscal 20232026 annual meeting of stockholders and until their successors are duly elected and qualified, subject to their earlier resignation or removal;

2.To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2021;2024;

3. To approve, on a non-binding, advisory basis, the compensation of our named executive officers ("NEOs"), as disclosed in this proxy statement;

4. To approve an amendment to our Seventh Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted pursuant to recent amendments to the Delaware General Corporation Law; and

3.5. To transact any other business that properly comes before the Annual Meeting (including any adjournments, continuations and postponements thereof).

Our board of directors recommends that you vote “FOR” the director nominees named in Proposal One, and “FOR” the ratification of the appointment of KPMG LLP as our independent public accounting firm as described in Proposal Two.Two, “FOR” the approval, on a non-binding, advisory basis, of the compensation of our NEOs as described in Proposal Three, and "FOR" the approval of the amendment of our Seventh Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted pursuant to recent amendments to Delaware General Corporation Law.

We have elected to provide access to our Annual Meeting materials, which include the proxy statement for our Annual Meeting (the “Proxy Statement”) accompanying this notice, in lieu of mailing printed copies.

On or about May 27, 2020,, 2023, we expect to mail tomailed our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access the Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended January 31, 20202023 filed with the Securities and Exchange Commission (the “2020"SEC") on March 23, 2023 (the “2023 Annual Report”). The Notice provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of proxy materials by mail. This Proxy Statement and our 20202023 Annual Report can be accessed directly at the Internet address www.proxyvote.com using the control number located on the Notice, on your proxy card or in the instructions that accompanied your proxy materials.

Only stockholders of record at the close of business on May 11, 20201, 2023 are entitled to notice of and to vote at the Annual Meeting as set forth in the Proxy Statement.

Your vote is important. Whether or not you plan to attend the Annual Meeting online, please ensure that your shares are voted at the Annual Meeting by signing and returning a proxy card or by using our Internet or telephonic voting system. If you attend the Annual Meeting online, you may vote during the meeting even if you have previously returned a proxy.

Thank you for your ongoing support of and continued interest in Phreesia.

Sincerely,

Chaim Indig

Chief Executive Officer

TABLE OF CONTENTS

Phreesia, Inc.

432 Park Avenue South, 12th Floor1521 Concord Pike, Suite 301, PMB 221

New York, New York 10016Wilmington, DE 19803

PROXY STATEMENT

FOR THE 20202023 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JULY 8, 2020JUNE 28, 2023

PROCEDURAL MATTERS

Our board of directors (the “Board”) solicits your proxy on our behalf for the 20202023 Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment, continuation or postponement of the Annual Meeting for the purposes set forth in this proxy statement for our Annual Meeting (this “Proxy Statement”) and the accompanying notice of Annual Meeting. The Annual Meeting will be held on July 8, 2020June 28, 2023 at 9:00 a.m. Eastern Time, virtually, via a live audio webcast on the Internet at www.virtualshareholdermeeting.com/PHR2020.PHR2023. You will be able to attend and participate in the Annual Meeting online by visiting www.virtualshareholdermeeting.com/PHR2020,PHR2023, where you will be able to vote electronically and submit questions. You will not be able to attend the Annual Meeting in person. You will need the 16-digit control number on your proxy card to attend the Annual Meeting.

We are making this Proxy Statement and our 2023 Annual Report on Form 10-K for the fiscal year ended January 31, 2023 filed with the Securities and Exchange Commission (the "SEC") on March 23, 2023 (the "2023 Annual Report") available to stockholders primarily via the Internet, instead of mailing printed copies of those materials to each stockholder. On or about May 27, 2020,, 2023, we mailed our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our 20202023 Annual Report on Form 10-K for the fiscal year ended January 31, 2020 (“2020 Annual Report”).Report. If you held shares of our common stock on May 11, 20201, 2023 you are invited to attend the meeting at www.virtualshareholdermeeting.com/PHR2020PHR2023 and vote on the proposals described in this Proxy Statement.

In this Proxy Statement, the terms “Phreesia,” “the Company,” “we,” “us” and “our” refer to Phreesia, Inc. ThePhreesia, Inc. is a fully remote company and no longer maintains its principal executive office. Our mailing address of our principal executive offices is Phreesia, Inc., 432 Park Avenue South, 12th Floor, New York, New York 10016.1521 Concord Pike, Suite 301, PMB 221, Wilmington, DE 19803.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON JUNE 28, 2023.

This Proxy Statement and the 2023 Annual Report are available online at www.proxyvote.com.

PROXY AND VOTING INFORMATION

| | | | | | | | |

| What matters are being voted on at the Annual Meeting? | You will be voting on: •The election of threeChaim Indig, Michael Weintraub and Edward Cahill as Class I directors to serve until the fiscal 20232026 annual meeting of stockholders or until their successors are duly elected and qualified; qualified, subject to their earlier resignation or removal; •A proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending January 31, 2021;2024; •A proposal to approve, on a non-binding, advisory basis, the compensation of our NEOs, as disclosed in this Proxy Statement; •A proposal to approve an amendment to our Seventh Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted pursuant to recent amendments to the Delaware General Corporation Law; and •Any other business as may properly come before the Annual Meeting.Meeting or any adjournment or postponement thereof.

| |

| | |

How does the Board recommend I vote on these proposals?

| Our Board recommends a vote:

•“FOR” the election of Chaim Indig, Michael Weintraub and Edward Cahill as Class I directors; and •“FOR” the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending January 31, 2021.2024; •“FOR” the approval, on a non-binding, advisory basis, of the compensation of our NEOs, as disclosed in this Proxy Statement; and • "FOR" the approval of an amendment to our Seventh Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted pursuant to recent amendments to the Delaware General Corporation Law.

| |

| | |

| | | | | | | | |

Who is entitled to vote?

| Holders of our common stock as of the close of business on May 11, 2020,1, 2023, the record date for the Annual Meeting (the “Record Date”), may vote at the Annual Meeting. As of the Record Date, there were 37,641,726 shares of our common stock outstanding. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of common stock is entitled to one vote on each proposal. |

| | | | | |

| Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote live at the Annual Meeting. Throughout this Proxy Statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders.Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in "street name," and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock live at the Annual Meeting unless you follow your broker's procedures for obtaining a legal proxy. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Throughout this Proxy Statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.” | |

| | | | | | | | |

| What do I need to be able to attend the Annual Meeting online? | We will be hosting our Annual Meeting via live webcast only. Any stockholder can attend the Annual Meeting live online at www.virtualshareholdermeeting.com/PHR2020.PHR2023. The webcast will start at 8:459:00 a.m. Eastern Time on July 8, 2020.June 28, 2023. Stockholders may vote and ask questions while attending the Annual Meeting online. In order to be able to attend the Annual Meeting, you will need the 16-digit control number, which is located on your Notice or proxy card (if you received a printed copy of the proxy materials). Instructions on how to participate in the Annual Meeting are also posted online at [www.proxyvote.com].www.proxyvote.com. Our virtual Annual Meeting will be governed by our Rules of Conduct, which will be available on the virtual meeting platform in advance of the Annual Meeting. The Rules of Conduct will address the ability of stockholders to ask questions during the meeting, including rules on permissible topics and rules for how questions and comments will be recognized and disclosed to meeting participants. | |

How many votes are needed | | |

| What is the required vote for approval of each proposal? | Proposal One:One: The election of directors requires a plurality of the voting power of the shares of our common stock present in person or by proxy at the Annual Meeting and entitled to vote thereonvotes properly cast to be approved. “Plurality” means that the nominees who receive the largest number of votes cast “FOR” such nominees are elected as directors. You may vote "FOR" or "WITHHOLD" on each of the nominees for election as director. Shares voting "withheld" and broker non-votes will have no effect on the election of the director nominees.

Proposal Two:Two: The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending January 31, 20212024 requires the affirmative vote of a majority of the votes properly cast.cast on this proposal. Abstentions and broker non-votes, if any, will have no effect on the ratification of KPMG LLP. Proposal Three: The approval of the compensation of our NEOs requires the affirmative vote of a majority of the votes properly cast on the proposal. Because this proposal is a non-binding, advisory vote, the result will not be binding on our Board, our compensation committee, or us. However, our Board and our compensation committee will consider the outcome of the vote when determining the compensation of our NEOs. Abstentions and broker non-votes will have no effect on the approval of the compensation of our NEOs. Proposal Four: The approval of an amendment to our Seventh Amended and Restated Certificate of Incorporation to limit the liability of certain officers of the Company as permitted pursuant to recent amendments to the Delaware General Corporation Law requires the affirmative vote of the majority of our outstanding shares of capital stock entitled to vote. This means that 50% of our outstanding shares on the Record Date must vote "FOR" this proposal. Abstentions and broker non-votes will have the same effect as a vote "AGAINST."

| |

| | |

| | | | | | | | |

| What is the quorum requirement? | A quorum is the minimum number of shares required to be present at the Annual Meeting to properly hold an annual meeting of stockholders and conduct business under our third amended and restated by-laws, or our bylaws, and Delaware law. The presence, in person or represented by proxy, of a majority of the issued and outstanding shares of our common stock entitled to vote on the Record Dateany matter will constitute a quorum at the Annual Meeting. As of the Record Date, there were shares of our common stock outstanding. Therefore, a quorum will be present if shares of our common stock are present, in person or by proxy, representing a majority of the shares of common stock entitled to vote as of the Record Date. Abstentions, withheld votes and broker non-votes are counted as shares present and entitled to vote for purposes of determining a quorum. |

| | |

| | |

| How do I vote? | If you are a stockholder of record, there are four ways to vote:

(1) By Internet (Before the Annual Meeting):You may vote over the Internet at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on July 7, 2020.June 27, 2023. You will need the 16-digit control number included on your Notice or proxy card (if you received a printed copy of the proxy materials);

(2) By Telephone: You may vote by toll-free telephone at 1-800-690-6903, until 11:59 p.m. Eastern Time on July 7, 2020.June 27, 2023. You will need the 16-digit control number included on your Notice or proxy card (if you received a printed copy of the proxy materials);

(3) By Mail: If you received printed proxy materials, you may submit your vote by completing, signing and dating each proxy card received and returning it promptly in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. Proxies submitted by U.S. mail must be received before the start of the Annual Meeting.Meeting; or

(4) By Internet (During the Annual Meeting): You may vote during the Annual Meeting by going to www.virtualshareholdermeeting.com/PHR2020.PHR2023. You will need the 16-digit control number included on your Notice or proxy card (if you received a printed copy of the proxy materials). If you previously voted via the Internet (or by telephone or mail), you will not limit your right to vote online at the Annual Meeting.

If you are a street name stockholder, please follow the instructions from your broker, bank or other nominee to vote by Internet, telephone or mail. Street name stockholders may not vote via the Internet at the Annual Meeting unless they receive a legal proxy from their respective brokers, banks or other nominees. | |

| | |

| | | | | | | | |

| Can I change my vote? | Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

•notifying our Corporate Secretary, in writing, at Phreesia, Inc., 432 Park Avenue South, 12th Floor, New York, New York 100161521 Concord Pike, Suite 301, PMB 221, Wilmington, DE 19803 before the vote is counted;

•voting again using the telephone or Internet before 11:59 p.m. Eastern Time on July 7, 2020June 27, 2023 (your latest telephone or Internet proxy is the one that will be counted); or

•attending the Annual Meeting online and voting virtually during the meeting. Simply logging into the Annual Meeting online will not, by itself, revoke your proxy.

If you are a street name stockholder, you may revoke any prior voting instructions by contacting your broker, bank or nominee. |

| | |

| | |

| What is the effect of giving a proxy? | Proxies are solicited by and on behalf of our Board. Charles KallenbachAllison Hoffman and Randy RasmussenBalaji Gandhi have been designated as proxy holders by our Board. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board as described above. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above. | |

| | |

| | | | | | | | |

| What is the effect of votes withheld, abstentions and broker non-votes? | Votes withheld from any nominee, abstentions and “broker non-votes” (i.e.(i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) arewill be counted as present for purposestowards the quorum requirement. With respect to Proposal One (election of determining the presence of a quorum. Shares voting “withheld”directors), withholding authority to vote your shares with respect to one or more director nominees will have no effect on the election of directors.those nominees. Abstentions will have no effect on theProposal Two (the ratification and appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending January 31, 2021. 2024) or Proposal Three (the non-binding advisory vote on the compensation of our named executive officers). Abstentions will be counted as votes against Proposal Four, as this proposal requires the affirmative vote of a majority of shares present and entitled to vote on the matter. Brokerage firms and other intermediaries holding shares of our common stock in street name for their customers are generally required to vote such shares in the manner directed by their customers. In the absenceIf you are a beneficial owner of timely directions,shares held in a brokerage account and you do not instruct your broker, will havebank or other agent how to vote your shares your broker, bank or other agent may still be able to vote your shares in its discretion. Under the rules of the New York Stock Exchange, brokers, banks and other securities intermediaries that are subject to New York Stock Exchange rules may use their discretion to vote your “uninstructed” shares on our solematters considered to be “routine” under New York Stock Exchange rules but not with respect to “non-routine” matters. A broker non-vote occurs when a broker, bank or other agent has not received voting instructions from the beneficial owner of the shares and the broker, bank or other agent cannot vote the shares because the matter the proposalis considered “non-routine” under New York Stock Exchange rules. Proposal Two to ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending January 31, 2021. Absent2024 is considered a "routine" matter, such that absent direction from you, your broker may vote your shares in its discretion on Proposal Two. Proposals One, Three and Four are considered to be "non-routine" matters and therefore your broker will not have discretion to vote your shares on Proposal One (election(the election of directors), which is a “non-routine” matter.Proposal Three (the non-binding advisory vote on the compensation of our NEOs), or Proposal Four (the amendment of our Seventh Amended and Restated Certificate of Incorporation). Broker non-votes will have no effect on Proposals One, Two or Three, but broker non-votes will have the same effect as votes "AGAINST" Proposal Four. | |

| | | | | | | | |

| | |

| Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials? | In accordance with the rules of the U.S. Securities and Exchange Commission (the “SEC”),SEC, we have elected to furnish our proxy materials, including this Proxy Statement and our 20202023 Annual Report, primarily via the Internet. On or about May 27, 2020,, 2023, we mailed to our stockholders a Notice that contains instructions on how to access our proxy materials on the Internet, how to vote at the meeting and how to request printed copies of the proxy materials and 20202023 Annual Report. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders. | |

| | |

| Where can I find the voting results of the Annual Meeting? | We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will provide preliminary voting results in the Current Report on Form 8-K and will provide the final results in an amendment to the Current Report on Form 8-K as soon as they become available. |

| | |

| | |

| How are proxies solicited for the Annual Meeting? | Our Board is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank or other nominee holds shares of our common stock on your behalf. In addition, our directors and employees may also solicit proxies in person, by telephone or by other means of communication. Our directors, officers and employees will not be paid any additional compensation for soliciting proxies. | |

| | |

| I share an address with another stockholder and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials? | We have adopted a procedure called “householding,” which is permitted by SEC rules. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials to multiple stockholders who share the same address, unless we have received contrary instructions from one or more of such stockholders. This procedure reduces our printing costs, mailing costs and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at legal@phreesia.comproxy@phreesia.com or:

Phreesia, Inc. Attention: Investor Relations and Legal Department 432 Park Avenue South, 12th Floor,521 Concord Pike, Suite 301, PMB 221

New York, New York 10016

Wilmington, DE 19803

Street name stockholders may contact their broker, bank or other nominee to request information about householding. | |

| | |

| | | | | | | | |

What isare the deadlinerequirements to propose actions for consideration at next year's annual meeting of stockholders or to nominate individuals to serve as directors? | Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at next year’sthe 2024 annual meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. Stockholder Proposals for Inclusion in Next Year's Proxy Statement For a stockholder proposal to be considered for inclusion in our proxy statement for the 20212024 annual meeting of stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not later than January 27, 2021., 2024. In addition, such stockholder proposals must comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

Phreesia, Inc. Attention: Investor Relations and Legal Department 432 Park Avenue South, 12th Floor1521 Concord Pike, Suite 301, PMB 221

New York, New York 10016Wilmington, DE 19803

with a copy via email: proxy@phreesia.com. Stockholder Proposals and Nominations to be Presented at Next Year’s Annual Meeting

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposalcertain matters, including nominations for the election of directors, before an annual meeting of stockholders, but do not intend for the proposal to be included in our proxy statement. Our amended and restatedUnder our bylaws, provide that the only business that may be conducted at an annual meeting of stockholders is business that is (i) specified in our proxy materials with |

| | | | | |

| respect to such annual meeting, (ii) otherwise properly brought before such annual meeting by or at the direction of our Board or (iii) properly brought before such meeting by a stockholder of record entitled to vote at such annual meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for the 20212024 annual meeting of stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

•not earlier than the close of business on March 10, 2021;February 29, 2024; and

•not later than the close of business on April 9, 2021.

March 30, 2024.

In the event that we hold the 20212024 annual meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, then, for notice by the stockholder to be timely, it must be received by our Corporate Secretary not later than the close of business on the later of the 90th day prior to the scheduled date of such annual meeting or the tenth day following the day on which public announcement of the date of such meeting is first made.

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting of stockholders does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at such annual meeting.meeting | |

Nomination of Director Candidates

Holders of our common stock may propose director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board and should be directed to our Corporate Secretary at 432 Park Avenue South, 12th Floor, New York, NY 10016. For additional information regarding stockholder recommendations for director candidates, see the section titled “Board of Directors and Corporate Governance—Stockholder Recommendations and Nominations to the Board.”

| | | | | | | | |

| In addition to satisfying the foregoing requirements under our amended and restated bylaws, permitto comply with the universal proxy rules, stockholders who intend to nominate directors for election at an annual meetingsolicit proxies in support of stockholders. To nominate a director the stockholdernominees other than our nominees must provide notice that sets forth the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time periods described aboveRule 14a-19 under the section titled “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.Exchange Act no later than April 29, 2024.

Availability of Bylaws

A copy of our amended and restated bylaws is available via the SEC’s website at http://www.sec.gov. You may also contact our Corporate Secretary at the address set forth above for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates. | |

| | | | | |

What does being an “emerging growth company” mean? | We qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise generally applicable to public companies. These provisions include:

•an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting;

•an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor's report providing additional information about the audit and the financial statements;

•reduced disclosure about our executive compensation arrangements;

•extended transition periods for complying with new or revised accounting standards; and

•exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangement.

We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.07 billion in annual revenue; the end of the fiscal year in which the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the second quarter of that fiscal year; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of our initial public offering. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act.

Under the JOBS Act, emerging growth companies can also delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected not to “opt out” of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, we will adopt the new or revised standard at the time private companies adopt the new or revised standard and will do so until such time that we either (i) irrevocably elect to “opt out” of such extended transition period or (ii) no longer qualify as an emerging growth company. This may make comparison of our financial statements with the financial statements of another public company that is not an emerging growth company, or an emerging growth company that has opted out of using the extended transition period, difficult or impossible because of the potential differences in accounting standards used.

|

| Why is this Annual Meeting being held virtually? | TheWe believe hosting a virtual meeting helps ensure the health and safety of our stockholders, Board and management and is consistent with our philosophy as a fully-remote company, and accordingly the Annual Meeting will be held entirely online this year. We are excited to embracehave embraced the latest technology to provide ease of access, real-time communication and cost savings for our stockholders and our company.Company. Hosting a virtual meeting provides easy access for our stockholders and facilitates participation because stockholders can participate from any location around the world. |

| | | | | |

| You will be able to participate in the Annual Meeting online and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/PHR2020.PHR2023. You will also be able to vote your shares electronically prior to or during the Annual Meeting. | |

| | |

| Who pays for the cost of this proxy solicitation? | Our Board is soliciting proxies for use at the Annual Meeting. We paywill bear the entire cost of preparing and distributing these proxy materials. In addition,materials and we may reimburse banks, brokersbrokerage houses and other custodians, nominees and fiduciaries representing beneficial owners of shares for their reasonable expenses in forwarding solicitation materials to such beneficial owners.our stockholders. Proxies may be solicited by certain of our directors, officers and employees, personally or by mail, telephone, facsimile, email or other means of communication (electronic or otherwise). No additional compensation will be paid for such services.

| |

PROPOSAL ONE:

ELECTION OF DIRECTORS

Number of Directors; Board Structure

Our Board is currently composed of seven members. In accordance with our Seventh Amended and Restated Certificate of Incorporation, our Board is divided into three staggered classes of directors. Onedirectors with one class is elected each year at the annual meeting of stockholders for a term of three years. The term of the Class I directors expires at the Annual Meeting. The term of the Class II directors expires at the 2021 annual meeting and the term of the Class III directors expires at the 2022 annual meeting. After the initial terms expire, directorsDirectors are expected to be elected to hold office for asuch three-year term or until the election and qualification of their successors in office.office, subject to their earlier resignation or removal. At the Annual Meeting three Class I directors named in this Proxy Statement are standing for election to the Board for a term that will expire at the 2026 annual meeting of stockholders.

Nominees

OurUpon the recommendation of our nominating and corporate governance committee, our Board has nominated Chaim Indig, Michael Weintraub and Edward Cahill for re-election as Class I directors, to hold office until the 20232026 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier resignation or removal. Each of the nominees is a current Class I director and member of our Board and has consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received “FOR” the election of each nominee. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by our present board.Board. In the alternative, the proxies may vote only for the remaining nominees, leaving a vacancy on our Board. Our Board may fill such vacancy at a later date or reduce the size of our Board. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Vote Required

The election ofUnder our bylaws, directors requiresare elected by a plurality of the voting power of the shares of our common stock be present in person or by proxyvotes properly cast at the Annual Meeting and entitledMeeting. This means that the three director nominees receiving the highest number of affirmative votes cast at the meeting will be elected as directors. You may vote "FOR" or "WITHHOLD" on each of the nominees for election as director. Withholding authority to vote thereonyour shares with respect to be approved.any of the director nominees will have no effect on the election of those nominees. Broker non-votes will have no effect on this proposal.the election of the nominees.

Recommendation of our Board

OUR BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES.

Information Regarding Director Nominees and Continuing Directors

The following table sets forth certain information about our directors, including our director nominees, as of May , 2023:

| | | | | | | | | | | | | | | | | | | | |

| Class | Age | Current Role(s) at Phreesia | Director Since | Current Term Expires | Expiration of Term for Which Nominated |

| Director Nominees: | | | | | | |

| Chaim Indig | I | 44 | CEO, Director | 2005 | 2023 | 2026 |

Michael Weintraub(2)(3)(4) | I | 64 | Chair, Director | 2005 | 2023 | 2026 |

Edward Cahill(2)(4) | I | 70 | Director | 2007 | 2023 | 2026 |

| Other Directors: | | | | | | |

Lainie Goldstein(1)(4) | II | 55 | Director | 2020 | 2024 | — |

Ramin Sayar(3)(4) | II | 50 | Director | 2021 | 2024 | — |

Gillian Munson(1)(2)(4) | III | 52 | Director | 2019 | 2025 | — |

Mark Smith, MD(1)(3)(4) | III | 71 | Director | 2018 | 2025 | — |

_______________________

(1) Member of the audit committee

(2) Member of the compensation committee

(3) Member of the nominating and corporate governance committee

(4) Independent member of the Board

The biographies of each of theour director nominees and continuing directors abovebelow contain information regarding each such person’s service as a director, business experience, director positions held currently or at any time during the last five years and the experiences, qualifications, attributes or skills that caused our Board to determine that the person should serve as a director of the company.Company. In addition to the information presented below regarding each nominee’s and continuing director’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or shesuch individual should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our companyCompany and our Board. Finally, weWe also value our directors' experience in relevant areas of business management and on other boards of directors and board committees and believe our Board committees.reflects a diversity of experience and perspectives and has an appropriate balance of members who have supported Phreesia from its beginning and who have joined more recently.

Directors

The following table sets forth information regarding our directors, including their ages, as of May 27, 2020:

| | | | | | | | | | | | | | | | | |

| Class | Age | Position(s) | Current Term Expires | Expiration of Term For Which Nominated |

| Employee Director: | | | | | |

| Chaim Indig | I | 41 | Chief Executive Officer, Director | 2020 | 2023 |

| Non-Employee Directors: | | | | | |

| Michael Weintraub(2)(3) | I | 61 | Chairman, Director | 2020 | 2023 |

| Edward Cahill(2) | I | 67 | Director | 2020 | 2023 |

| Scott Perricelli(1)(2) | II | 48 | Director | 2021 | N/A |

| Cheryl Pegus, M.D., M.P.H.(3) | II | 56 | Director | 2021 | N/A |

| Mark Smith, M.D.(1)(3) | III | 68 | Director | 2022 | N/A |

| Gillian Munson(1) | III | 49 | Director | 2022 | N/A |

_______________________

(1) Member of the audit committee.

(2) Member of the compensation committee.

(3) Member of the nominating and corporate governance committee.

Information Concerning Director Nominees

Chaim Indig has served as ourPhreesia’s Chief Executive Officer and as a member of ourits Board since inceptionco-founding the Company in January 2005. Mr. Indig has helped shape the healthcare experience and improve outcomes for patients, providers and staff. Under his leadership, Phreesia has established a broad national footprint, developed strategic partnerships with some of the world’s largest healthcare companies, and earned accolades for the Company’s role in helping to make care more efficient and patient-centered. He also led Phreesia through its initial public offering in 2019 and was named one of The Software Report’s Top 50 SaaS CEOs in 2021. Prior to co-founding Phreesia, Mr. Indig ledspearheaded the successful introduction of the analytics software company, Spotfire, Inc., into the pharmaceutical marketing

space. Mr. Indig was a finalist for Ernst & Young’s “Entrepreneur of the Year” Award in 2011 and was featured in the Stanford Social Innovation Review as a healthcare innovator. We believe that Mr. Indig’s extensive knowledge and experience in all aspects of our business and his extensive experience in the healthcare technology industry make him qualified to serve on our Board.Board.

Michael Weintraubhas served as Founding ChairmanChair and as a member of our Board since January 2005. Mr. Weintraub serves as Co-Founder and Managing Partner of Ardan Equity, Partners, LLC, a healthcare enterprise software private equity firm, since April 2019. Previously, Mr. Weintraub served as Managing Partner of Optum Venture Management LLC, a company focused on digital health innovation, from 2017 to 2018. Mr. Weintraub was Co-Founder and Chief Executive Officer of Humedica, Inc., a population health management and big data company, from 2008 until 2013. After Humedica, Inc. was acquired by UnitedHealth Group, or UHG, in 2013, Mr. Weintraub served as President and Chief Executive Officer of Optum Analytics, UHG, from 2013 until 2017. Prior to launching Humedica, Inc., Mr. Weintraub served as Senior Managing Director at Leerink Partners LLC, a healthcare investment bank. Mr. Weintraub also served as Chief Executive Officer of PharMetrics, Inc. from 2001 until 2005, a healthcare informatics company, which was acquired by IMS Health, Inc., now IQVIA Holdings Inc., in 2005. Mr. Weintraub currently serves as chairmanChair of the board of directors of BroadReach Healthcare, LLC, a global healthcare company and Holmusk Ltd, a data analytics and Corrona, LLChealth technology company, and as a member of the board of directors of Oncology Analytics,CorEvitas, LLC, Forsyth Health, OncoHealth, Newfire, LLC and The Diabetes Link, formerly known as The College Diabetes Network, and as an advisory board member of the Innovation and Digital Health Accelerator at Boston Children’s Hospital. Mr. Weintraub also focuses on healthcare innovation as an Entrepreneur in Residence at Harvard Business School. Mr. Weintraub received his bachelor’s degree in Economics from Brandeis University in Boston, Massachusetts and an M.B.A. from Harvard Business School in Boston, Massachusetts.School. We believe that Mr. Weintraub’s experience as an executive in the healthcare industry, as a director for a number of healthcare and data analytics companies, and his knowledge of the healthcare technology industry make him qualified to serve on our Board.

Edward Cahillhas served as a member of our Board since October 2007. Mr. Cahill serves as Managing Partner at HLM Venture Partners, which invests in emerging healthcare, business services, and technology companies, a position he has held since May 2000. From June 1995 until May 2000, Mr. Cahill was a Founding Partner of Cahill, Warnock & Company (now Camden Partners Holding, LLC), a Baltimore private equity firm. Prior to that, Mr. Cahill was a Managing Director of Alex.Alex, Brown & Sons, Inc., where he headed the firm’s Healthcare Group from 1986 through 1995. Mr. Cahill serves as a member of the board of directors of Tandem Diabetes Care,Blue Rabbit Ventures, Inc., Carevive Systems, Inc., Binary Fountain Inc. and Persivia Inc., and serves as emeritus trustee of Johns Hopkins Medicine, Johns Hopkins Health System, and trustee at Mercy Health Services. Mr. Cahill previously served as a member of the

board of directors of many public and privately held companies including but not limited to Covetrus,Tandem Diabetes Care, Inc., Masimo Corp., Centene Corp., and TyRx, Inc. Mr. Cahill holds a B.A. from Williams College in Williamstown, Massachusetts, and a Master of Public and Private Management degree from Yale University in New Haven, Connecticut.University. We believe that Mr. Cahill’s experience in serving on the board of directors of numerous public and private companies and his investment experience with healthcare companies make him qualified to serve on our Board.

Information Concerning Continuing Directors

Scott Perricelli

Lainie Goldstein has served as a member of our Board since October 2014. Mr. Perricelli has over 20 years of investment banking and private equity experience. He currentlyJuly 2020.Ms. Goldstein serves as PartnerChief Financial Officer of LLR PartnersTake-Two Interactive Software, Inc. ("Take-Two"), a leading global interactive entertainment company, a position heshe has held since 2008. He has been employed by LLR Partners Inc. since 2001.June 2007. Ms. Goldstein is a CPA with financial and business experience in the software, entertainment, retail and apparel industries, with proven success in managing the finance function of publicly traded companies. Prior to joining LLR Partners Inc., Mr. Perricelli wasTake-Two, Ms. Goldstein held a Principalnumber of positions of increasing responsibility with Nautica Enterprises, most recently serving as Vice President, Finance and Business Development. Earlier in her career, she held positions in the audit and reorganization departments at Draper Triangle Ventures LP from 2000 to 2001, an associate at Advanta Partners, L.P. from 1997 to 1999 and worked at William Blair & Company, L.L.C. and J.P. Morgan Chase & Co. from 1994 to 1997. Mr. Perricelli currently serves as member of the board of directors of Benefitexpress LLC, Eye Health America, Kemberton Healthcare Services LLC, Physicians Immediate Care LLC and Schweiger Dermatology Group, PLLC. Mr. Perricelli also serves on the Children’s Hospital of Philadelphia Foundation Board of Overseers and the Bucknell University Board of Trustees. Mr. Perricelli received his B.S. DegreeGrant Thornton LLP. Ms. Goldstein holds a BSBA in Accounting from Bucknell University in Lewisburg, Pennsylvania and an M.B.A. in Finance and Entrepreneurship from the Kellogg School of Management at Northwestern University in Evanston, Illinois.The American University. We believe that Mr. Perricelli’s experience advisingMs. Goldstein’s extensive public company leadership, business and investing in numerous growth businessesfinancial expertise across a broad range of industries make himher qualified to serve on our Board.

Cheryl Pegus, M.D., M.P.H.

Gillian Munson has served as a member of our Board since May 2019. Dr. PegusMs. Munson currently serves as Chief MedicalFinancial Officer of Vimeo, Inc., a video hosting, sharing and Senior Vice President of Health Care Services for Cambia Health Solutions, Inc.,services platform, a position she has held since 2018. Previously, Dr. Pegus was PresidentApril 2022. Ms. Munson previously served as Special Advisor to the chief financial officer of Caluent LLC,One Medical, a healthmembership-based primary care data analytics company,practice, from 2013October 2021 to 2018 and a Clinical Professor of Medicine and Population Health at NYU Langone Medical Center from 2014 to 2017.March 2022. Prior to that, Dr. PegusMs. Munson was Chief Financial Officer of Iora Health, Inc., a healthcare company, from December 2020 until its sale in September 2021. Ms. Munson previously served as a Partner at Union Square Ventures. Prior to that, she served as Chief Financial Officer, Treasurer and Secretary of XO Group Inc., the first Chief Medical Officerparent company of Walgreen Co.’s health care services, product launchesThe Knot Inc., from 2013 until 2019. Ms. Munson also held previous roles of Vice President, Business Development at Symbol Technologies, LLC, Executive Director and data analytics unit, from 2010 to 2013. Dr. PegusSenior Equity Analyst at Morgan Stanley and Equity Research Associate at Hambrecht & Quist. She currently serves on the board of directors of Duolingo, Inc., and The St. Regis Foundation and previously served on the board of directors of Monster Worldwide, Inc. Ms. Munson earned her B.A. in Political Science and Economics from The Colorado College. We believe that Ms. Munson’s public company leadership positions as Chair of the Board of the Association of Black Cardiologistsan officer and as a board member, of Tactile Systems Technology, Inc.as well as her investment and US Acute Care Solutions, LLC. Dr. Pegus earned her B.A. degree from Brandeis University in Waltham, Massachusetts, her M.D. from Weill Cornell Medical College in New York, New York and her Master’s in public health from Columbia University Mailman School of Public Health in New York, New York. We believe Dr. Pegus’equity research experience as a physician and her background in the healthcaretechnology industry, make her qualified to serve on our Board.

Mark Smith, M.D., MBA.

Ramin Sayarhas served as a member of our Board since October 2021. Mr. Sayar is the Chief Executive Officer and a member of the board of directors of Sumo Logic, Inc., a software company where he has served since December 2014. From April 2010 to December 2014, Mr. Sayar served as Senior Vice President and General Manager, Cloud Management Business Unit at VMware, Inc., a software virtualization company. From November 2006 to April 2010, Mr. Sayar served as Vice President of Products and Strategy at HP Software Technology Pvt. Ltd., a software development company. Mr. Sayar holds a B.A. in History from the University of California, Santa Barbara and an M.B.A. from San Jose State University. We believe Mr. Sayar’s experience as the chief executive officer and board member of a software company makes him qualified to serve on our Board.

Mark Smith, M.D., M.B.A. has served as a member of our Board since October 2018. Dr. Smith is currently Professor of Clinical Medicine at the University of California at San Francisco. From 2015 to 2019 he served as co-chair of the Guiding Committee of the Health Care Payment Learning and Action Network. Previously, Dr. Smith was the founding President and former Chief Executive Officer of the California Healthcare Foundation, Inc., a philanthropic organization focused on improving the health of individuals, from 1996 to 2013. Dr. Smith serves as a member of the board of directors of Jazz Pharmaceuticals plc, Teladoc Health, Inc., the Commonwealth Fund, the Institute for Healthcare Improvement, Prealize, and Concerto Healthcare, Inc.Prealize. Dr. Smith earned his B.A. degree in Afro-American Studies from Harvard College, in Cambridge, Massachusetts, his M.D. from the University of North Carolina inat Chapel Hill, North Carolina, and his M.B.A. in Healthcare Administration from the Wharton School at the University of Pennsylvania in Philadelphia, Pennsylvania. We believe that Dr. Smith’s experience as a physician and his background in health policy and the healthcare industry make him qualified to serve on our Board.

Gillian Munson has served as a member

The following chart shows key attributes for the seven current members of our Board sinceas of May 2019. Ms. Munson currently serves, 2023, including the three nominees:

The matrix below summarizes what our Board believes are desirable types of experience, qualifications, attributes and skills possessed by one or more of our independent directors as a Partner at Union Square Venturesresult of their particular relevance to our business and is responsible for firm operations as well as investments. Previously, she served as Chief Financial Officer, Treasurerstructure. While all of these were considered by the Board and Secretarythe nominating and corporate governance committee in connection with this year’s director nomination process, the following matrix does not encompass all experience, qualifications, attributes or skills of XO Group Inc., the parent company of The Knot Inc., from 2013 until 2019. Prior to that, Ms. Munson served as Managing Director at Allen & Company LLC, where she led principal investing and outreach activities with early stage technology companies. Ms. Munson also held previous roles of Vice President, Business Development at Symbol Technologies, LLC, Executive Director and Senior Equity Analyst at Morgan Stanley and Equity Research Associate at Hambrecht & Quist. She currently serves on the board of directors of Sweet Briar College, Duolingo, Inc., and The St. Regis Foundation, and previously served on the board of directors of Monster Worldwide, Inc. Ms. Munson earned her B.A. in Political Science and Economics from The Colorado College in Colorado Springs, Colorado. We believe that Ms. Munson’s public company leadership position as an officer and as a board member, as well as her investment and equity research experience in the technology industry, make her qualified to serve on our Board.directors.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | Software Industry Experience | Healthcare Industry Experience | Public Company Director Experience (non-Phreesia) | Senior Business Executive Experience | Financial Statements and Accounting Experience |

Privacy/Data Security Experience | Gender | Race/ Ethnicity |

Tenure since IPO |

| Michael Weintraub | X | X | | X | X | X | M | White | 4 years |

| Ed Cahill | | X | X | X | X | | M | White | 4 years |

| Lainie Goldstein | X | | | X | X | X | F | White | 2 years |

| Gillian Munson | X | X | X | X | X | X | F | White | 3 years |

| Ramin Sayar | X | | X | X | | X | M | Asian and Middle Eastern | 1 year |

| Mark Smith | | X | X | X | | | M | African American or Black | 4 years |

CORPORATE GOVERNANCE

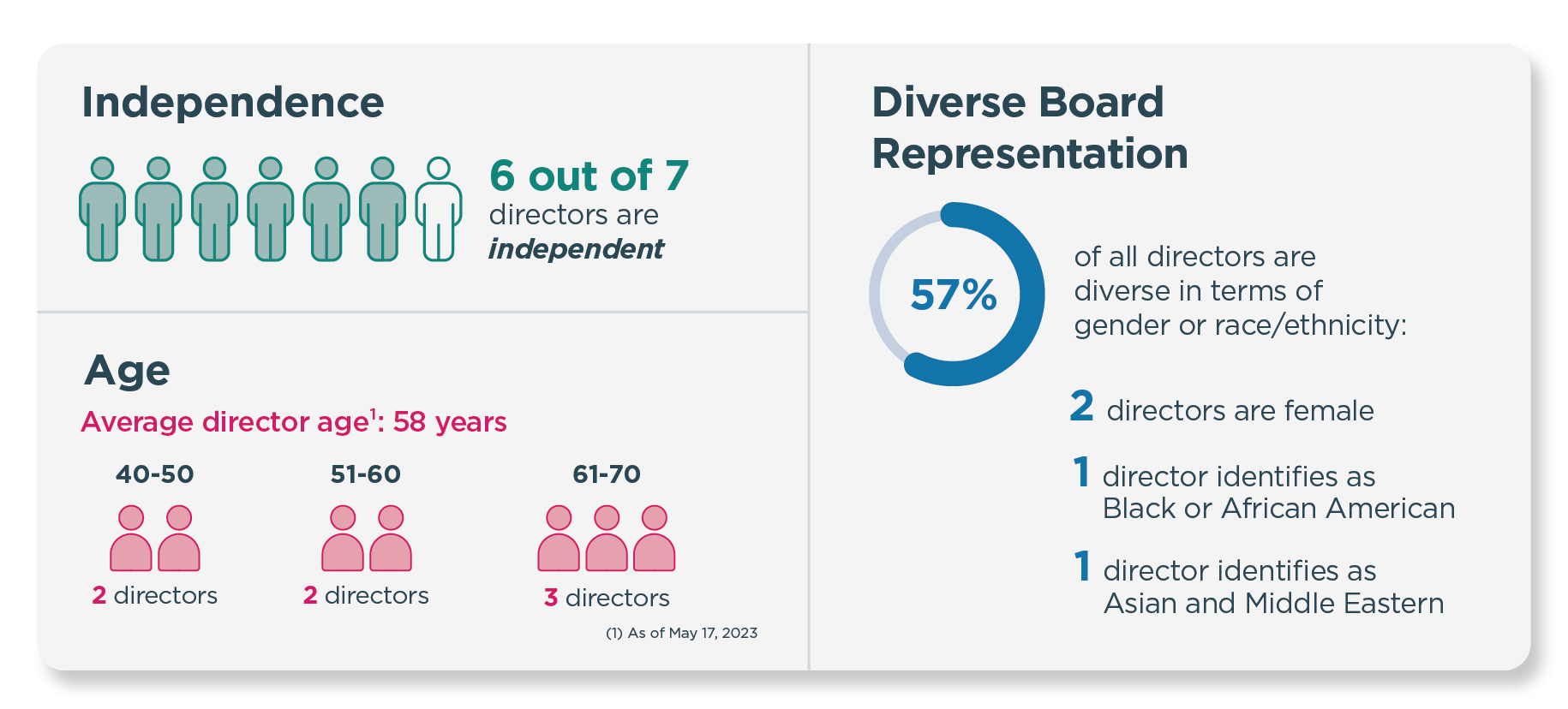

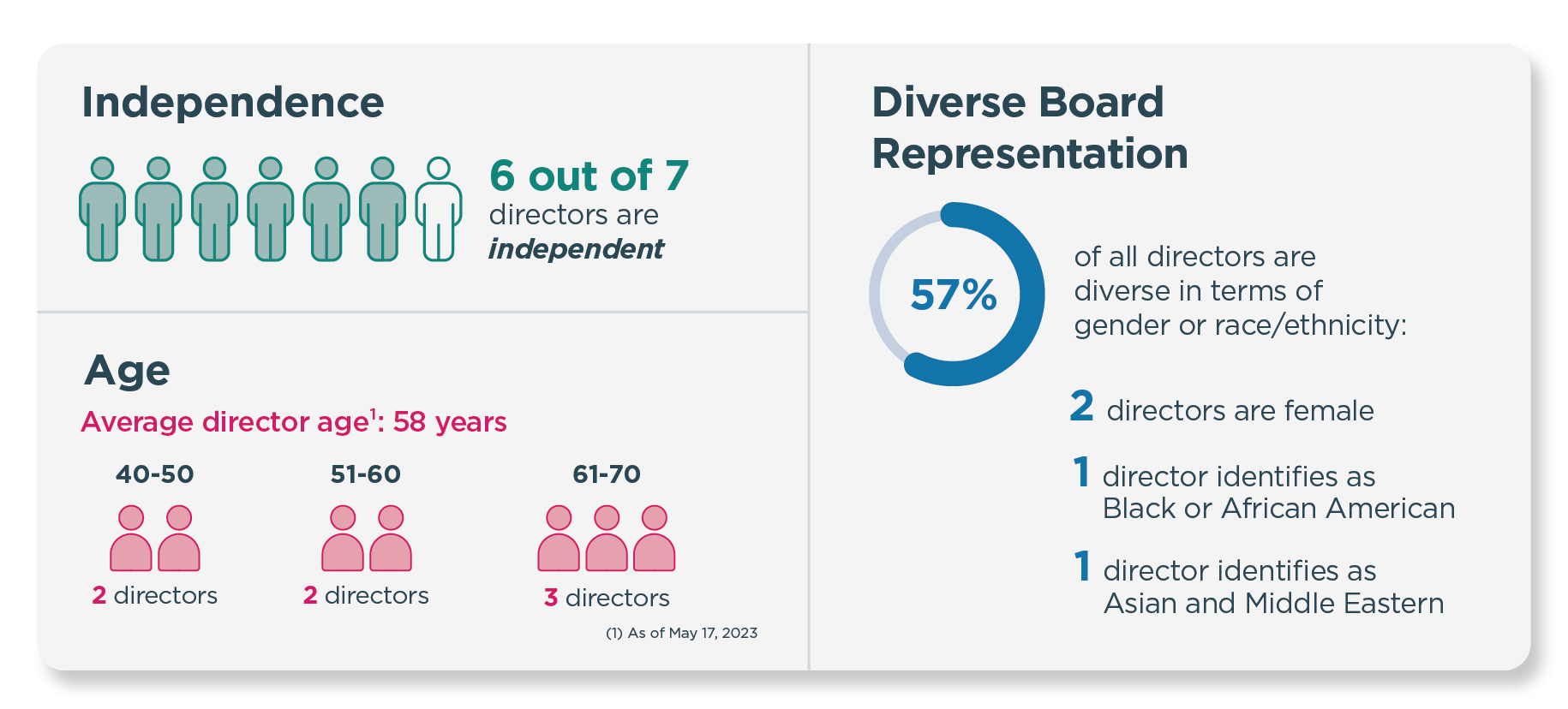

We are committed to effective corporate governance that is informed by our stockholders, promotes the long-term interests of our stockholders, and strengthens our Board and management accountability. Some highlights of our governance program include:

| | | | | | | | | | | | | | |

| ü | Highly independent Board (6 of 7 directors) and a goal of independence of 2/3 of the Board | | ü | Fully independent audit, compensation, and nominating & corporate governance committees |

| ü | Diverse Board in terms of gender, race/ethnicity, experience, skills and tenure | | ü | Separate Chair and CEO positions |

| ü | Single class of stock with equal voting rights | | ü | Ongoing Board refreshment |

| ü | Annual Board and committee evaluations | | ü | Regular executive sessions of independent directors |

| ü | Stock ownership guidelines for directors and executive officers | | ü | Director overboarding policy |

| ü | Average tenure goal for Board members of 10 years or less | | | |

Our business and affairs are managed under the direction of our Board, which is elected by our stockholders. Our Board currently consists of seven directors, all of whom, other than Mr. Indig, qualify as “independent” under the listing standards of the New York Stock Exchange.Exchange (“NYSE”).

Director Independence

Our common stock is listed on the New York Stock Exchange.NYSE. Under the listing standards of the New York Stock Exchange,NYSE, independent directors must comprise a majority of a listed company's board of directors. In addition, the listing standards of the New York Stock ExchangeNYSE require that, subject to specified exceptions, each member of a listed company's audit, compensation and nominating and corporate governance committees be independent. Under the listing standards of the New York Stock Exchange,NYSE, a director will only qualify as an “independent director” if, in the opinion of that listed company’s board of directors, that director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act, of 1934, as amended (the “Exchange Act”), and the listing standards of the New York Stock Exchange.NYSE. Compensation committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the listing standards of the New York Stock Exchange.NYSE.

Our Board has undertaken a review of the independence of each director. Based on information provided by each director concerning his or hersuch director's background, employment and affiliations, our Board has determined that none of Mr. Weintraub, Mr. Cahill, Ms. Goldstein, Ms. Munson, Mr. Perricelli, Dr. Pegus,Sayar or Dr. Smith and Ms. Munson do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that each of these directors is “independent” as that term is defined under the listing standards of the New York Stock Exchange.NYSE. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our companyCompany and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, the association of our directors with the holders of more than 5% of our common stock, and the transactions involving them described in the section titled “Certain Relationships and Related Party Transactions.Transactions,” if applicable.

Board Leadership Structure

The positions of Chief Executive Officer and ChairmanChair of our Board are separated. Michael Weintraub serves as the ChairmanChair of our Board, presides over meetings of our Board and executive sessions of our Board and holds such other powers and carries out such other duties as are customarily carried out by

the ChairmanChair of our Board. Chaim Indig, our Chief Executive Officer, sets the overall strategy of the Company and oversees our day-to-day business. Our Board believes that separating these roles is appropriate as it allows us to pursue strategic and operational objectives while maintaining effective oversight and objective evaluation of corporate performance. Our Board believes that separating these positions allows our Chief Executive Officer to focus on setting the overall strategic direction of the company,Company, expanding the organization to deliver on our strategy and overseeing our day-to-day business, while allowing the ChairmanChair of the Board to lead the Board in its fundamental role of providing strategic advice to and independent oversight of management.

Our Board recognizes the time, effort and energy that the Chief Executive Officer is required to devote to his position in the current business environment, as well as the commitment required to serve as our Chairman,Chair, particularly as the Board’s oversight responsibilities continue to grow. Although our amended and restated bylaws and corporate governance guidelines do not require that our ChairmanChair and Chief Executive Officer positions be separate, our Board believes that having separate positions is the appropriate leadership structure for us at this time and demonstrates our commitment to good corporate governance.

Board’s Role in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through our Board as a whole, as well as through its standing committees that address risks inherent in their respective areas of oversight. In carrying out its risk oversight responsibilities, the Board reviews the long- and short-term internal and external risks facing the Company through its participation in long-range strategic planning, and ongoing reports from various Board standing committees that address risks inherent in their respective areas of oversight. On a regular basis, key risks, status of mitigation activities and potential new or emerging risks are discussed with senior management and further addressed with our audit committee and Board, as necessary. On an ongoing basis, the Board and management identify key long- and short-term risks, assess their potential impact and likelihood, and, where appropriate, implement operational measures and controls or purchase insurance coverage in order to help ensure adequate risk mitigation.

In particular, our Board is responsible for monitoring and assessing strategic risk exposure. Our Board also monitors new risks as they emerge, such as the effects on our business of Russian military action in Ukraine and adverse developments in the financial services industry. Our audit committee is responsible for reviewing and discussing our major financial and accounting risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies with respect to risk assessment and risk management. Our audit committee also monitors operational, privacy, security, cybersecurity, and competition risk and compliance with legal and regulatory requirements, in addition to oversight of the performance of our external audit function. Our audit committee is also responsible for periodically reviewing our enterprise risk management program and supporting framework. Our nominating and corporate governance committee monitors the effectiveness of our corporate governance guidelines, and evaluates our Board and committees' composition.composition and oversees our environmental, social and governance ("ESG") initiatives. Our compensation committee reviews and discusses the risks arising from our compensation philosophy and practices applicable to all employees that are reasonably likely to have a materially adverse effect on us.

Risks Related to Compensation Policies and Practices

When determining our compensation policies and practices, the Board considers various matters relevant to the development of a reasonable and prudent compensation program, including whether the policies and practices are reasonably likely to have a material adverse effect on us. We believe that the mix and design of our executive compensation plans and policies do not encourage management to assume excessive risks and are not reasonably likely to have a material adverse effect on us for the following reasons: we offer an appropriate balance of short and long-term incentives and fixed and variable amounts; our variable compensation provides enhanced incentives for executives to outperform and strong disincentives for executives to underperform against our Company goals and is based on a

balanced mix of Company performance criteria; and the Board and Compensation Committee have the authority to adjust variable compensation as appropriate.

Anti-HedgingCorporate Governance Guidelines and Anti-Pledging PoliciesCode of Business Conduct and Ethics

Certain transactionsOur Board has adopted Corporate Governance Guidelines that address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our Board has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors including our Chief Executive Officer, Chief Financial Officer and other executive and senior financial officers. A copy of our Corporate Governance Guidelines and Code of Business Conduct and Ethics is available on our Internet website at https://ir.phreesia.com/about-us/governance-documents and may also be obtained without charge by contacting our Corporate Secretary at Phreesia, Inc., 1521 Concord Pike, Suite 301, PMB 221, Wilmington, DE 19803. We intend to disclose any amendments to our Code of Business Conduct and Ethics, or waivers of its requirements, on our website or in filings under the Exchange Act, as required by the applicable rules and exchange requirements. During fiscal year ended January 31, 2023, no waivers were granted from any provision of the Code of Business Conduct and Ethics.

Environmental, Social and Governance Topics

At Phreesia, we are guided by our commitment to responsible business practices through a culture that promotes honest and ethical conduct, respects our employees and communities, and safeguards the information under our care. We are committed to making a positive impact and continuing to assess and enhance our ESG strategy to meet the needs of our stakeholders.

Our Employee Experience

Our focus on our employee experience and a strong company culture has earned us third-party recognition in a number of areas, as evidenced by the following recent recognitions:

•Phreesia named to Modern Healthcare’s 2022 list of “Best Places to Work in Healthcare” for the sixth time

•Phreesia named to Inc. Magazine’s list of “Best-Led Companies of 2022”

•Phreesia Life Sciences named to Medical Marketing and Media’s (MM+M) “Best Places to Work 2022”

•Phreesia included in 2023 Bloomberg Gender Equality Index for the third year in a row

•Representation on Software Report's Top 50 Women Leaders in SaaS for the past five years

•Phreesia named as one of the 2023 Achievers 50 Most Engaged Workplaces

We believe in treating all people with respect and celebrating our diverse backgrounds, ideas, and perspectives. To support the Phreesia community, we are committed to the practices highlighted below:

•Commitment to Ethical Conduct. At a fundamental level, we are committed to honest, ethical and respectful conduct. We have implemented policies and practices to uphold this commitment in the workplace, such as our annual anti-harassment training. Our Code of Business Conduct and Ethics also reaffirms our commitment to fostering a respectful workplace culture that is free of harassment, intimidation, bias, and unlawful discrimination. We strictly prohibit discrimination in all its forms, including on the basis of race, sex, marital status, sexual orientation, gender identity, gender reassignment, national origin, age, disability and genetic information, as well as any other attribute protected by law. We encourage employees to ask questions, seek guidance, and report suspected violations of our Code of Business Conduct and Ethics. We offer avenues for anonymous reporting and protect employees from any retaliation for good faith reports.

•Employee Engagement. As part of our effort to build a positive, inclusive company culture, we conducted our first employee engagement survey in fiscal year 2023 through the Workday

Peakon platform. We provided all leaders throughout our organization with a comprehensive and team-level view of our strengths and opportunities, along with support, tools, resources and guidance through a strategic action planning process. Throughout the year, we used the results of our engagement survey to drive our operational and strategic actions.

•Welcoming New Employees. We have structured a thorough and welcoming virtual onboarding program for new employees, who complete a set of core trainings, live courses and exercises to understand the "why" of Phreesia and learn our values. Our interactive, multi-day onboarding program also offers new employees meaningful opportunities to connect with colleagues. We strive to provide all employees with the tools they need to build successful connections and to maintain and strengthen virtual-first relationships across the organization. We aim to empower new hires to leverage their unique backgrounds and experiences to impact the Company and to build a solid foundation for their success at Phreesia and their future career growth.

•Prioritizing Health and Wellness. We offer unlimited paid time off and summer Fridays to all employees and a competitive benefits package, including a variety of health plans, dental and vision coverage, and short-term, long-term and life insurance plans. We also encourage healthy lifestyles by offering a monthly wellness stipend, as well as Company-sponsored wellness programs, including our Phall Wellness Challenge. We aspire to create an environment and culture that supports all our employees when they need to provide support to their families, and we are proud to offer paid family care leave to our North American employees. In addition, we have implemented Phireworks, an employee rewards program where employees can recognize their colleagues for various achievements by awarding them points that can be used to purchase items in the Phireworks store or make charitable contributions.

Our Culture

Phreesia employees are a team of smart and passionate individuals who are dedicated to our mission of creating a better, more engaging healthcare experience for patients, healthcare services clients and staff. At every level of the organization, we encourage a culture of personal responsibility, built on trust and accountability. We draw on these values to guide the following tenets of our culture:

•Diversity, Equity, Inclusion, & Belonging.We are committed to hiring, developing and supporting a diverse and inclusive workplace. Our employee resource groups (“ERGs”) support our commitment to promoting and maintaining an inclusive culture for all employees by bringing together individuals from a wide range of backgrounds, experiences and perspectives. These groups seek to foster a sense of shared community and empowerment for employees who share a common social identity, such as gender, race, ethnicity, sexual orientation and ability. Phreesians can voluntarily join an ERG to network, discuss and exchange ideas and enhance their professional development, notably through our ERG mentorship program. Our active ERGs include Phreesia Women’s Network, Black@Phreesia, LatinX, LGBTQ+@Phreesia, PHR-Asians, MENA (Middle Eastern/North African), and Phree & Able (promoting disability inclusion and awareness).

We are also committed to supporting gender equality in our securities (suchorganization, including through our inclusive culture, board representation, pathways to leadership for women, pay equity and strong family-leave policies.

•Trust and Flexibility. At every level of our organization, we encourage a culture of personal responsibility. We trust our employees to know how to execute on our mission, and we give them space to do so as purchasesthey manage their work and salespersonal lives. We promote work-life balance by empowering our employees to adopt flexible working arrangements and providing tools for efficient remote collaboration. We also offer a stipend to make sure our employees’ remote workspaces are set up for comfort and productivity.

•Transparency and Engagement. Transparency and engagement are critical to communication within the Phreesia community and employee connections. In fiscal 2023 we conducted our first employee engagement survey. We use the feedback we gather to create an even better workplace experience. We also communicate openly with our employees through weekly all-company calls and newsletters, where we deliver business updates, celebrate wins, recognize outstanding employee contributions, and cover other topics relevant to our employees and clients.

•Contributing to our community. We recognize the importance of publicly traded putgiving back to our communities. We encourage our employees to participate in optional “Phriendsgiving” Phreesia Service Days each November to serve our local communities. Phreesians can volunteer individually, connect with others to volunteer, or opt into projects we organize in major cities with ten or more employees. We have also implemented Benevity, a corporate giving platform, to encourage Phreesians to give back to their communities and call options,causes that matter to them. Phreesians are encouraged and short sales) createsupported to share their time and resources to give back to their communities locally and beyond. For example, we established the Earnest Rogers Award as a heightened complianceway to pay tribute to a late beloved Phreesia friend and colleague. The annual award goes to a Phreesian who demonstrates kindness, integrity, dependability, gratitude and authenticity in their work and life. Each year, Phreesia makes a donation in honor of Earnest to the recipient's charity of choice.

Sustainability

We are committed to monitoring and managing our operations to better understand and continuously improve our impact on the environment. We have a relatively low carbon footprint as a software-as-a-service company, and we strive to further minimize our footprint by tailoring our operations towards sustainability. For example, we have lessened the environmental burden of commuting by operating as a remote company, supporting our workforce through technology tools that enable virtual communication and collaboration. We strive to reuse or recycle our corporate IT equipment across our workforce and

follow applicable guidelines for disposal of electronic waste. We have also consolidated our corporate data centers to utilize energy-efficient vendors and to run workloads in a dense manner, reducing excess energy usage. We continue to investigate additional ways to increase the adoption of environmentally sustainable practices.

Privacy and Security